2022 Report on customer experience in asia-pacific region

Learn about the primary trends impacting CX professionals in APAC and key challenges and obstacles CX practitioners are currently facing

Add bookmarkListen to this content

Audio conversion provided by OpenAI

State of CX in APAC region

Businesses must constantly enhance the experiences they deliver. Why? Because otherwise brands risk losing clientele to competitors due to the rising customer expectations triggered by the innovative customer experiences delivered by market trailblazer brands. CX Network’s Global State of Customer Experience 2021 confirmed that the vast majority of customers will switch brands if they are unsatisfied with a provider’s level of service. In response to this reality, research by computer software company Adobe found that 59 percent of APAC businesses are increasing their investment in customer experience management to meet these expectations.

The World Economic Forum (WEF) has found that Asia-Pacific (APAC) is home to over 55 percent of consumers globally, meaning the region holds vast opportunities for brands. For companies to be successful they need to be conscious of the various cultural and linguistic preferences and customs that exist within different regions, so that they can customize their services and experiences accordingly. CX Network’s The realities of customer experience in APAC report observed that to gain a competitive edge within this region, digital experience excellence is a critical trend to master.

Based on a survey by CX Network of 112 CX practitioners across Asia-Pacific, this report will explore the key CX trends, customer behavior shifts, spend priorities and experience management pain points that are developing in the region.

Also read: VoC in APAC experts insight ebook

About the respondents

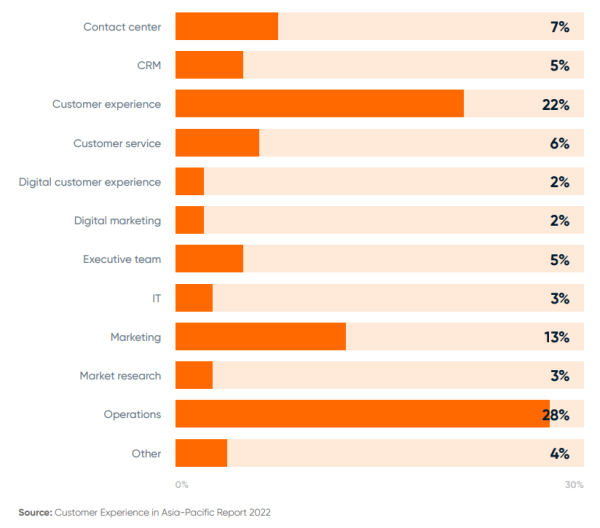

CX Network’s CX Trends in Asia Pacific report series has now entered its fourth year. To get a better understanding of the survey results, here is a visual breakdown of the 112 customer experience experts surveyed, including their seniority, company size, industry, geography and budget.

Job title

Function

Industry

CX investment decision-making

CX trends in APAC

Top 10 CX trends in APAC

Digital customer experience

Digital customer experience, the act of companies using digital platforms to deliver services to customers, has risen in prominence. This year almost one in four (23 percent) respondents said digital experiences were the most important trend in the APAC region. In 2021’s The realities of customer experience in APAC report, it also featured in the top three trends of artificial intelligence/ chatbots (41 percent), data and analytics (36 percent) and digital customer experience (36 percent).

The decline in bricks-and-mortar retailing, accelerated by the Covid-19 pandemic, has increased the need for seamless e-commerce experiences. Computer software company Adobe reported that over three quarters (77 percent) of APAC businesses experienced a surge in new customers through digital channels in the past 18 months. This means that frictionless digital customer experiences are now essential for engaging and retaining customers.

Digital technologies empower companies to provide proactive support to customers, says KV Dipu, head of operations and customer service at Bajaj Allianz General Insurance. Through sophisticated service integration with digital devices, customers can have more convenient experiences. Dipu explains: “For example, if a customer crashes their car, they no longer have to call their insurer and [then] wait for a surveyor to be deployed immediately to the site of the crash. In the age of digital CX, they can instead take photographs of the car and upload them immediately to our systems using our mobile app.”

Artificial intelligence and chatbots

Artificial intelligence (AI) and chatbots are reportedly still on the rise in alignment with last year’s results, with 13 percent of the APAC practitioners surveyed labelling the two as top CX trends. The use of AI is especially useful in the APAC region as it can expand a company’s linguistic capabilities, allowing them to interact with customers in their language of preference. This is essential to businesses within APAC as there are more than 14 languages and over 18 dialects spoken across the region.

InMoment’s managing director of APAC, David Blakers, has witnessed the growing popularity of AI use, especially amongst CX improvement programs. These technologies are used to help uncover actionable insights amongst unstructured data as new digital experience features disrupt traditional customer journeys.

“When Covid-19 sent the world into lockdown, brick and mortar brands had to shut their doors, meaning digital experiences were the only ones available to consumers,” Blakers explains. “But, as the status of the pandemic shifts and safety regulations ebb and flow, so too must the array of digital and in-store experiences brands offer. Gone are the days where the experience was either in store or online. Consumers now expect experiences that blend the two.”

Customer loyalty and retention

Winning and retaining customer loyalty remains a prominent trend, with 17 percent of respondents citing it as one of their top three trends. Both AI and digital experiences act as useful tools for winning and retaining customers, which is the main objective of CX professionals.

To win customer loyalty, Yvette Mihelic, director of customer experience for rail and transport at construction, tunnelling, rail, building and services company John Holland and member of the Australian Institute of Company Directors, advises companies to infuse empathy into their customer service. She says that companies can do this by using frontline teams and digitized interactions that are personalized to individuals rather than market groups. This can help organizations secure higher sales ratios through increased customer satisfaction – essentially demonstrating the monetization of customer experience.

“As the status of the pandemic shifts and safety regulations ebb and flow, so too must the array of digital and in-store experiences brands offer. Gone are the days where the experience was either in store or online. Consumers now expect experiences that blend the two.”

David Blakers

Managing director of APAC, InMoment

Customer behavior in APAC

How customer behavior in APAC is progressing

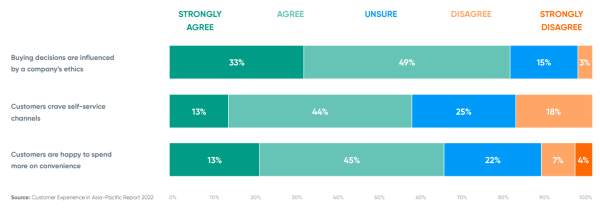

The CX APAC practitioners were asked to evaluate the changing behaviors of their APAC consumers, and rate whether they agreed with the following statements

The pressure on APAC brands to be socially responsible is reportedly on the rise in the Asia-Pacific region, with 80 percent of respondents agreeing that buying decisions are influenced by a company’s ethics and transparency. Market research company Mintel found that 60 percent of APAC consumers are willing to boycott companies who behave unethically.

Brands should engage with their customers on their company ethics and any social initiatives they have in place. Businesses should also be transparent about timelines so customers have clear expectations on how long these practices will take to implement.

Joshua Tye, senior customer operations leader at mobile payment service Cash App, explains: “A socially responsible organization empathetically evaluates customer’s decisions. The most responsible teams leverage diversity and environmentalist perspectives to elevate consumer outcomes.”

It is also clear from the results that convenience is an important priority for customers, with 69 percent of respondents stating customers crave self-service channels, and 65 percent observing that customers are happy to spend more financially to receive a more convenient service.

Rajesh Rao, head of intelligent process automation at Nokia, notes that the Covid-19 pandemic forced brands to innovate so they can offer convenient services. He warns that it will be nearly impossible to roll back the conveniences offered during the crisis, and so customer expectation will shift to demand even more from brands.

Also read: Data & analytics in APAC

Looking forward, Rao suggests companies use process mining to uncover high-value opportunities to create added convenience for customers.

Ayelet Medel-Girin, general head of customer experience at financial technology Humm Group, advises that many customers prefer to use self-serve channels in the comfort and convenience of their own home. Self-service channels put control in the hands of customers and give them access to implement solutions themselves. This allows them to address pain points 24/7, regardless of time zones and they do not need to wait for an agent to be free.

Companies should fully understand customer needs and customer service goals before implementing self-service solutions, so as not to apply an unsatisfactory solution. Even though they were built with the intention to help customers, self-serve channels that feature fractured processes, hide access to human agents and fail to capture all frequently asked questions, can end up creating more frustration for users.

“A socially responsible organization empathetically evaluates customer’s decisions. The most responsible teams leverage diversity and environmentalist perspectives to elevate consumer outcomes.”

Joshua Tye

Senior customer operations leader at mobile payment service Cash App

CX challenges in APAC

Top 10 CX challenges in APAC

Respondents were able to select more than one challenge

Linking CX initiatives to ROI and competing priorities

Proving the return of CX investments (ROI) has remained a top challenge for brands across APAC, with 38 percent of respondents in 2021 flagging it as their number one challenge. In this year’s survey, 21 percent of respondents feel linking ROI to CX initiatives is a top challenge.

While ROI remains a top concern for companies, this drop in percentage highlights a growth in practitioners’ abilities to demonstrate the financial benefits of customer experience investments. This is helpful as the requirement to prove ROI in CX is stronger than ever. Almost half (46 percent) of respondents said that urgency is rising to prove the ROI of CX. In order to win budget and resources, CX practitioners must prove to decision makers that CX investments will achieve financial rewards for their company. Therefore, it is vital that CX practitioners use the correct communication tactics in order to win stakeholder buy-in and prove the benefits of CX solutions.

David Blakers, managing director of Asia-Pacific at InMoment, notes that CX practitioners have a strong chance of winning spend for CX if they can demonstrate how their CX efforts help to increase revenue, decrease costs, and reduce business risk.

The urgency to prove return on investment (ROI) in CX is:

Blakers also recommends building a ROCXI (return on customer experience investment) framework to continually report against.

“To win the minds of your executive leadership team, it is really important for each listening post to think about the related operational and finance measures already being used by the business and link to those so the program is relevant,” he says.

Building a customer-first culture

Achieving customer loyalty by building a customer first culture remains an issue of focus for APAC CX practitioners, with 19 percent reporting that building a customer-first culture was a top challenge in 2022. However, this represents a 19 percent drop from 38 percent of respondents in 2021. This decrease in the strength of this challenge shows that companies across APAC are gaining momentum in building customer-first cultures.

To improve its position in the healthcare market Medibank, an Australian health insurer, conducted a corporate transformation which aimed to increase customer loyalty by building a customer-first culture.

Partnering with InMoment, the health insurer aligned front-line staff incentives with customer experience goals as well as implementing a robust voice of the customer (VoC) program to increase awareness of client perspectives.

This customer-first culture triggered a growth in policyholder numbers and saw Medibank achieve its highest-ever brand Net Promoter Score (NPS).

“To win the minds of your executive leadership team, each listening post should think about the operational and finance measures already being used by the business and link to those so the program is relevant.”

David Blakers

Managing director of APAC, InMoment

CX investment priorities

Top CX spend priorities in APAC

Toughest CX investment challenges

Respondents were able to select more than one challenge

Investment goals

Here we explore how CX practitioners are investing to overcome the CX challenges they face and the trends they need to tap into. While there were a broad range of responses, overall, there were three main spend priorities: customer loyalty and retention (10 percent), CX automation (9 percent) and digital customer experience (9 percent).

Also read: Predective CX in APAC

The results indicate that CX APAC practitioners are willing to financially invest into the industry trends they highlighted in the opportunities section of this report, namely artificial intelligence/chatbots, digital customer experience and customer loyalty and retention. Additionally, as 17 percent of respondents are investing over US$2.5mn in customer experience solutions, this shows that brands are willing to allocate a large amount of spending to CX investments.

When looking to invest in and encourage customer experience transformation, Dialog Axiata’s Rekha Weerasooriya says that brands who fail to adjust to the new digital age will fall behind.

“It is crucial to have clarity around your digital strategy, where your brand wants to get to and how it will empower its employees to contribute to its growing technical sophistication,” says Weerasooriya.

Annual budgets for CX solutions (US$):

ROI and budget

The main obstacles complicating the investing in CX solutions were finance-based, with 20 percent and 18 percent of respondents respectively citing demonstrating ROI and finding budget as major hurdles.

InMoment’s Blakers suggests companies prove the ROI of CX (ROCXI) by demonstrating how economic pillars will be strengthened by an experience program. These pillars include:

- Customer acquisition.

Understand the market environment and changing consumer preferences.

- Customer retention.

Address organizational or procedural issues that negatively impact customer experience.

- Cross-sell and upsell.

Identify opportunities to expand loyalty and share of wallet within existing customer base across your unique customer journeys.

- Minimize costs.

Find areas for achieving greater efficiency and eliminating failure demand, ultimately lowering your overall cost to serve.

“It is crucial to have clarity around your digital strategy, where your brand wants to get to and how it will empower its employees to contribute to its growing technical sophistication.”

Rekha Weerasooriya

Dialog Axiata

By linking back to these economic pillars, CX practitioners should be able to convince budget holders that CX is a strategic, and crucial, focus area worth dedicating resources to.

Integration into existing tools

The integration of new technologies into existing CX tools was also flagged as an investment challenge by 15 percent of APAC CX practitioners. Failure to correctly integrate new technology into existing tools can create data and tech silos, which ultimately leaves the business in a worse position than before the integration as a lack of interconnectivity between systems blocks the flow of information across departments.

To overcome internal silos, global hotel booking platform SiteMinder opted to centralize its technologies, which included an open-source Asterisk phone and software system. The software system was made up of four servers, hosted in two separate countries – one in the US and the other in Thailand. As a result, the travel company was experiencing international system fragmentation and silos that damaged its ability to serve customers and negatively impacted customer experiences. The overcome these silos, SiteMinder fully integrated its technologies into a customer relationship management (CRM) platform. This helped improve international employee collaboration and communication with handover messages between the brand’s 100 contact center agents. Michael Badham, IT director of SiteMinder says the new infrastructure allows the company to seamlessly offer “follow-the-sun support” for its customers.

“When one region is closed, support calls are automatically routed to another office in a different part of the world,” he says. “This has improved our response times significantly and our clients have noticed big improvements.”

Channel integration

How close is your brand to providing an omnichannel model?

Over a third of respondents (35 percent) say they have a multichannel model with fragmented connections. This follows on from the data explored in the rest of the report, as 15 percent of those surveyed noted channel integration as a major obstacle to their CX investments.

However, while some companies may be struggling with omnichannel integration, there are some companies turning the tide against fragmentation with almost a third (31 percent) of respondents reported having some level of synergy between channels, and 12 percent reported that they had an omnichannel model. This is an increase from the data revealed in CX Network’s The hidden cost of point-solution chaos in businesses across Asia-Pacific 2021 report, where no Asia Pacific respondents could state they had connections between all channels or that they had an omnichannel model.

When companies are looking to integrate channels to an omnichannel solution, David Blakers, managing director for Asia-Pacific at InMoment, suggests that companies focus initially on hygiene drivers like reducing customer effort and improving the effectiveness of each interaction, then move to strategic drivers like the emotional connection with the brand. This allows businesses to explore not just the customer experience in a single channel, but the consistency of experiences across channels and the way each customer feels following an interaction. For example, after a purchase does the customer now feel more confident in their choice or perceive greater value in the brand’s offering.

“This approach ensures understanding of how experiences online, on the phone, or store location work together to impact a customer’s satisfaction and ultimately engender loyalty,” Blakers explains.

“Focus initially on hygiene drives like reducing customer effort then move to strategic drivers like emotional connection with the brand”.

David Blakers

Managing director of Asia-Pacific at InMoment

Final remarks

Companies in APAC are starting to overcome the challenges they faced in 2021, including customer centricity, linking ROI to CX and providing an omnichannel model. In order to remain ahead of the curve on these issues and not regress, they should look to be continuously improving their processes and invest in key CX solutions that will benefit them and their customers. These solutions include artificial intelligence/automation and digital customer experience.

By applying these solutions, brands will be able to deliver the customer experience that consumers expect, and boost customer loyalty and retention. When increasing customer loyalty, brands should be sure to demonstrate the financial benefits to win the support of budget holders for future CX investments.

Additionally, companies should look to inspire customer loyalty and retention by paying close attention to trends in customer behavior. As customers crave more convenient, self-service-based solutions, companies should design experiences that meet these expectations. In addition, as customer concerns revolve more around company ethics and social responsibility, businesses should be transparent with them about their processes and any social initiatives the company either currently has or are planning to implement.

APAC brands who take advantage of these trends will put themselves in an advantageous position to deliver to customer preferences, achieving a competitive advantage over companies who fail to do so.